Insurance & Estate Planning

Here we look to address the Question:

“Do I have any financial blind spots?”

.

Insurance and estate planning play crucial roles in protecting both you and your family.

Here we look to address the Question: “Do I have any financial blind spots?” At this stage, we determine if there is anything you might have overlooked that might do you, your family or your business harm. Any risk exposure we uncover will be brought to your attention and we will provide a rational strategy designed to help mitigate the risk.

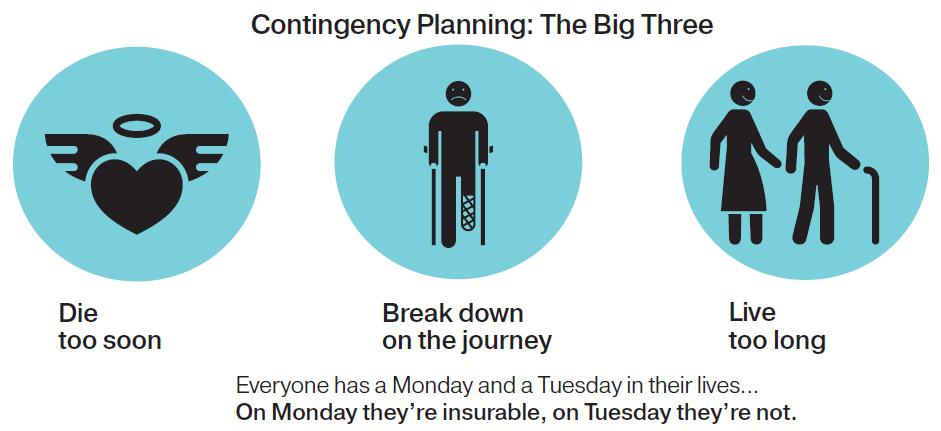

As part of our comprehensive wealth management strategy, we help you protect against three major contingencies that can devastate you, your family and/or your business financially:

1. You can die too soon 2. You can live too long 3. Or you can break down on the journey

We work closely with your attorney to ensure that your estate is structured and funded in a way that mitigates these three contingencies.

Unlike any other investment decision we make, this one is always on the clock. If we decide to invest in a particular stock or portfolio manager, we can do that pretty much at any time in the near future with nominal impact. However, when it comes to contingency planning and the use of insurance products “everyone has a Monday and Tuesday in their lives…on Monday they’re insurable, and on Tuesday they’re not.”

Unlike any other investment decision we make, this one is always on the clock. If we decide to invest in a particular stock or portfolio manager, we can do that pretty much at any time in the near future with nominal impact. However, when it comes to contingency planning and the use of insurance products “everyone has a Monday and Tuesday in their lives…on Monday they’re insurable, and on Tuesday they’re not.”

As a matter of principle we always make sure to pack our lifesavers before we take your financial craft out to sea.

.

“Helping you feel confident and secure about your future is at the heart of what we do.”

.

INSURANCE PLANNING refers to the process of assessing risks and deciding which risks to self insure and which risks to transfer to an insurance company.

Do You Have a Financial “Plan B”?

Insurance becomes an important part of the equation. Your investment plan isn’t worth much if daily life throws you a few curveballs you aren’t prepared to handle. A well-developed financial plan includes a detailed analysis of your “financial blindspots” and the need for protection against various risks:

-

Life insurance, for replacing income lost with the death of a breadwinner.

-

Income Protection insurance, in case a breadwinner can’t work.

-

Long-Term Care insurance, to protect against care costs draining your assets.

-

Property and casualty insurance, such as for homes, cars and boats, and against floods and earthquakes.

-

Personal liability insurance, including an umbrella (excess liability) policy.

The bottom line is that to develop a well thought out financial plan, it’s critical to consider all of the various risks that could derail it.

.

What Will Your Legacy Be?

Watch this powerful video discussing one of the most unselfish things you can do.

ESTATE PLANNING refers to the process of making and implementing advanced decisions designed to:

- Provide for financial security during lifetime.

- Address the issues that would be present in the event of incapacity before death, e.g., a disability, a long term care need.

- Facilitate your wishes as to the transfer of assets at death – where, what, when, how.

- Provide for maximum control of assets for the eventual distribution; whether to family members, friends, or to charity.

“There is more to estate planning

than just writing a Last Will and Testament”.

.

Please ask yourself the following:

-

Have we executed a Will, a Power of Attorney, and Medical Directives?

-

When were these last reviewed?

-

Do we have children or parents with special needs requiring specialized care?

-

If a business owner, have I created and implemented a business succession plan?

-

Did I make provisions for the difference between owners and managers?

-

Are we taking advantage of current estate planning techniques to minimize or eliminate potential estate taxes?

-

Have we made provisions for the changing estate tax laws?

-

Did we have a family conference to discuss our planning with our successors and beneficiaries?

‘

‘

Effective estate planning aims to preserve and control the maximum amount of wealth possible for YOUR intended beneficiaries; and at the same time providing you with the desired level of financial security and flexibility during your lifetime. Let us help you begin the process of organizing your affairs in order to more thoughtfully and effectively plan for the future.

.

Be sure to download “The 4 Pillars of a Successful Legacy Strategy” below.

“It isn’t enough simply to sign a bunch of papers establishing an estate plan and other end-of-life instructions. You also have to make your heirs aware of them and leave the documents where they can find them.”

Click here to check out our financial document organization kit. (“File Safe” program) 4 Pillars of Your Legacy

View Your Legacy Brochure here.

Please contact us here to set up an initial appointment to begin the process of articulating, designing, and implementing your financial and estate plans.

If daytime appointments are not convenient, we can schedule weeknight or week-end appointments as well.

“Our goal is to help simplify your financial life so you have more time to spend on your quality of life and the things that matter most to you.”