Social Security Resource Center

“We Help You Plan For Tomorrow, So You Will Achieve The Retirement You Deserve.”

Millions of baby boomers are set to retire in the next 20 years, and most will rely on Social Security as an important source of retirement income. As they approach retirement, Americans want to understand how Social Security works. How much will they receive from Social Security? When should they begin receiving retirement benefits? What Social Security options and filing strategies are available? These are some of the topics that our Social Security Resource Center explores.

Before You Claim Social Security

Before You Claim Social Security

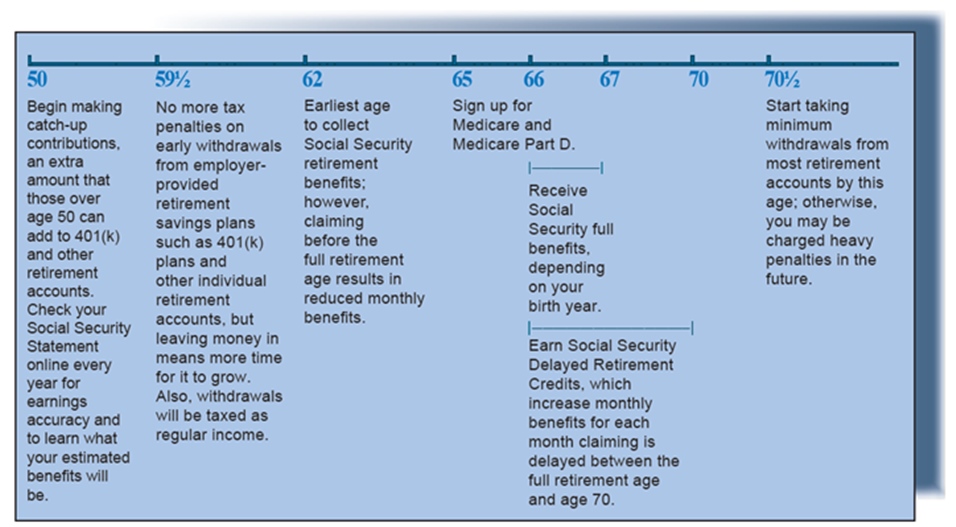

Timeline for Retirement Planning

Social Security – Basics of Social Security Benefits

- Asses your retirement income needs.

- Evaluate different social security filing strategies.

- Develop a comprehensive income strategy to help integrate your Social Security benefits with other sources of retirement income.

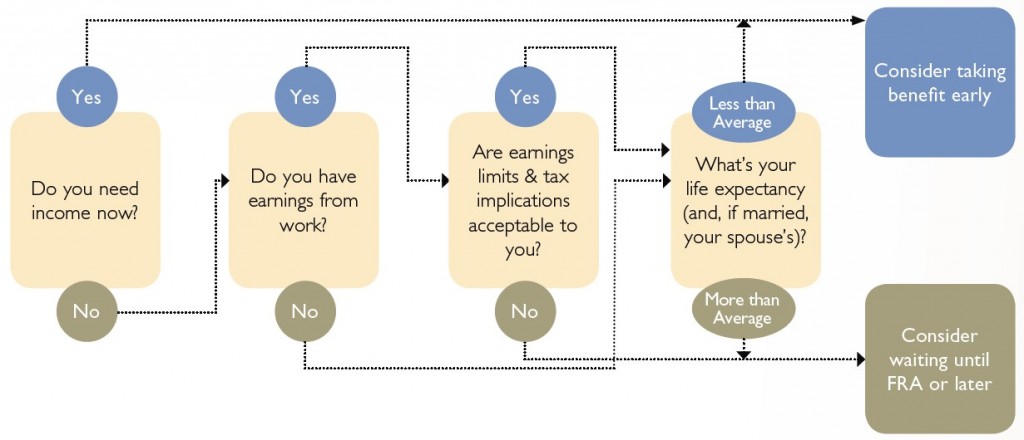

A Social Security Decision Tree

Start at the beginning… with your advisor.

Seeing the big picture can be difficult when there seems to be a panorama of choices and decisions. As you draw closer to retirement, you should begin considering how social security will fit into the big picture, and what you want to do with your benefits. Getting the most from Social Security is more than a casual decision, and more than simply guessing how long you’ll live.

Making a decision based upon a simplistic analysis could cost you a great deal of money. To maximize Social Security benefits you should craft a claiming strategy based upon your unique life circumstances.

Making a decision based upon a simplistic analysis could cost you a great deal of money. To maximize Social Security benefits you should craft a claiming strategy based upon your unique life circumstances.

Will you retire early? Are you depending on a spouse’s or ex spouse’s earnings record? What income benefit filing strategy is best for your situation? Do you have dependents who will still need your support? So, there’s a lot to think about- and a lot at stake- when it comes to Social Security. By answering some important questions now with your advisor, you can bring the big picture into focus.

You may benefit from seeking the advice of an advisor that specializes in retirement income planning, who can incorporate your Social Security claiming options into an overall retirement income plan.

.

Request a personal customized Social Security Planning Report of your own.

Retirement landscape

Retirement is different now than it was in past generations. These days, individuals have varying expectations for how they wish to spend their retirement years. Many planning factors are interconnected, which require careful consideration when developing a retirement strategy.

COMMON MISCONCEPTIONS

“I’ll continue to work during retirement.”

• 73% of employed Americans plan to work beyond age 65 — but only 27% of current retirees actually did.

• A number of factors can cause people to retire earlier than expected, including health problems, employer issues and family obligations.

“I need to claim my Social Security benefits as soon as I can.”

• Claiming Social Security before full retirement age can significantly reduce your benefits.

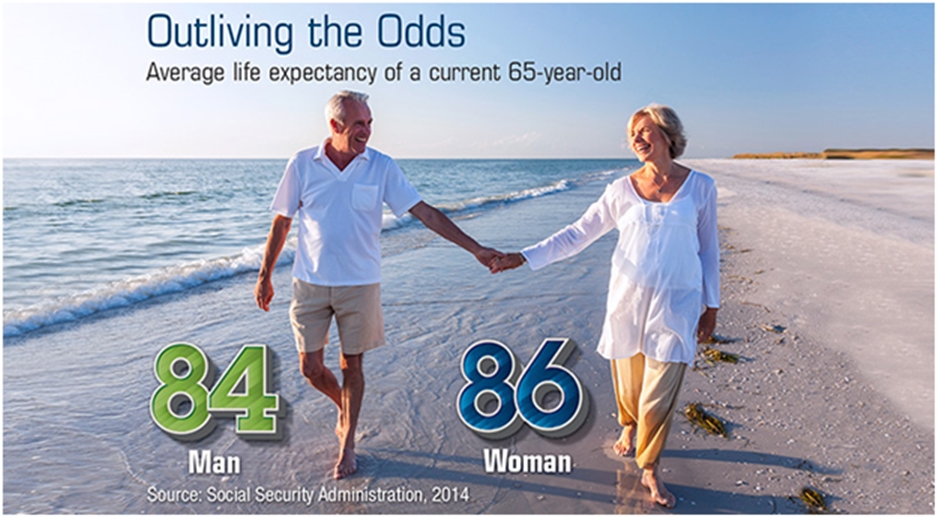

• Increasing life expectancies may make it beneficial to delay benefits.

“My spending patterns won’t change much when I retire.”

• The inflation rate is higher for retirement-age Americans who spend disproportionately more on items that rise fastest in price, such as health care.

Checkout the JP Morgan “Guide to Retirement” for more Retirement info.

Over the last few years, we have stressed the importance of optimizing social security benefits in our financial planning analysis. As Social Security is a major source of retirement income for many people, we believe that it is important for you to have a good understanding of the different claiming strategies, and by selecting the best strategy, you could potentially add hundreds of thousands of additional income over your lifetime.

We can prepare a personal customized analysis to illustrate different retirement situations and explain the claiming strategies selected to maximize benefits. Our belief is that proper planning for Social Security is a key part of anyone’s retirement planning.

Request a personal customized Social Security Planning Report of your own.

As a goal for all clients, we want to be able to provide peace of mind in your retirement years. Being able to maximize your lifetime income stream from Social Security is one way that you are able to achieve this. Remember, IT’S ABOUT YOU!

Third party links disclosure – By clicking on these links, you will leave our website. The link you have selected is located on another server. We have not independently verified the information available through these links. The links are provided to you as a matter of interest.

Request Social Security Statement. Cost of Living Information. How to replace, correct, or change your name on your social security card. Benefit information publications. How to apply for social security retirement benefits. Electronic newsletter.

.

Life Expectancy Calculator – http://www.socialsecurity.gov/planners/lifeexpectancy.htm

When you are considering when to collect retirement benefits, one important factor to take into account is how long you might live.

.

General information on Social Security retirement benefits

The Social Security Handbook – http://www.socialsecurity.gov/OP_Home/handbook/handbook-toc.html

Social Security Retirement Planner – http://www.ssa.gov/retire2/

Social Security Program Fact Sheet – http://www.ssa.gov/OACT/FACTS/index.html

.

How to apply for benefits

Apply Online For Social Security Benefits, SSA Publication No. 05-10032. – http://www.socialsecurity.gov/retirement/about.htm

Social Security Forms – http://www.ssa.gov/online/

.

How benefits are calculated

Social Security Benefit Amounts. – http://www.ssa.gov/OACT/COLA/Benefits.html

.

Benefit calculators

SSA benefit calculators – http://www.ssa.gov/planners/benefitcalculators.htm

Retirement Estimator – http://www.ssa.gov/planners/calculators.htm

Windfall Elimination Provision online calculator – http://www.ssa.gov/retire2/anyPiaWepjs04.htm

.

Coordinating spousal benefits

Benefits for your spouse. – http://www.socialsecurity.gov/retire2/yourspouse.htm

Benefits for your divorced spouse. – http://www.socialsecurity.gov/retire2/yourdivspouse.htm

.

Third party links disclosure – By clicking on these links, you will leave our website. The link you have selected is located on another server. We have not independently verified the information available through these links. The links are provided to you as a matter of interest.

This material about Social Security and all information shown, including any examples, is provided for educational purposes only and does not constitute tax, legal, or other individualized advice. While the information contained herein has been obtained from sources deemed reliable, Lighthouse Financial Strategies cannot be held responsible for any direct or indirect loss resulting from the application of the information provided here. Individuals should consult a qualified tax professional or attorney regarding their specific situation.

“Helping you feel confident and secure about your future is at the heart of what we do.”

1