Navigating Volatile Markets

“The pessimist complains about the wind;

the optimist expects it to change;

the realist adjusts the sails.”

~ William Arthur Ward

.

We all know the stock market can be unpredictable. We all want to know, “What’s next for the financial markets?”

.

When you set out on a voyage, you know where you want to go but you may not know the best way to get there. Together, we will determine where you want to go, the likely conditions that can affect your route, and how much turbulence you can tolerate along the way.

At Lighthouse Financial Strategies we offer many different comprehensive solutions designed to help you reach your goals. We guide your investments with confidence, like a global positioning system for your portfolio, aiming to keep you on course during both fair weather and foul. Our strategies were created to help you avoid emotional decision-making and confidently navigate unpredictable markets.

.

Disciplined…“We believe that removing emotion from the decision making process can help generate enhanced risk-adjusted returns.“

With the secular bear market of the last decade still fresh in our minds, today many people question simple buy-and-hold stock and bond strategies that in the past were nearly universally accepted as the most sensible way to invest.

With the secular bear market of the last decade still fresh in our minds, today many people question simple buy-and-hold stock and bond strategies that in the past were nearly universally accepted as the most sensible way to invest.

We believe the reason that many investors have experienced substantial losses in their investment strategies recently is that they are primarily following the “sailing” strategies of the great bull market of the 80’s and 90’s, when they should be including a component of “rowing” strategies in the more volatile and challenging markets of this decade.

.

“Investing in the market is important for long-term success…but so is capital preservation during times of market stress.”

We believe there are times to take advantage of the market environment and times when the priority is simply to avoid market risk. This is why we feel a flexible approach to investing is needed.

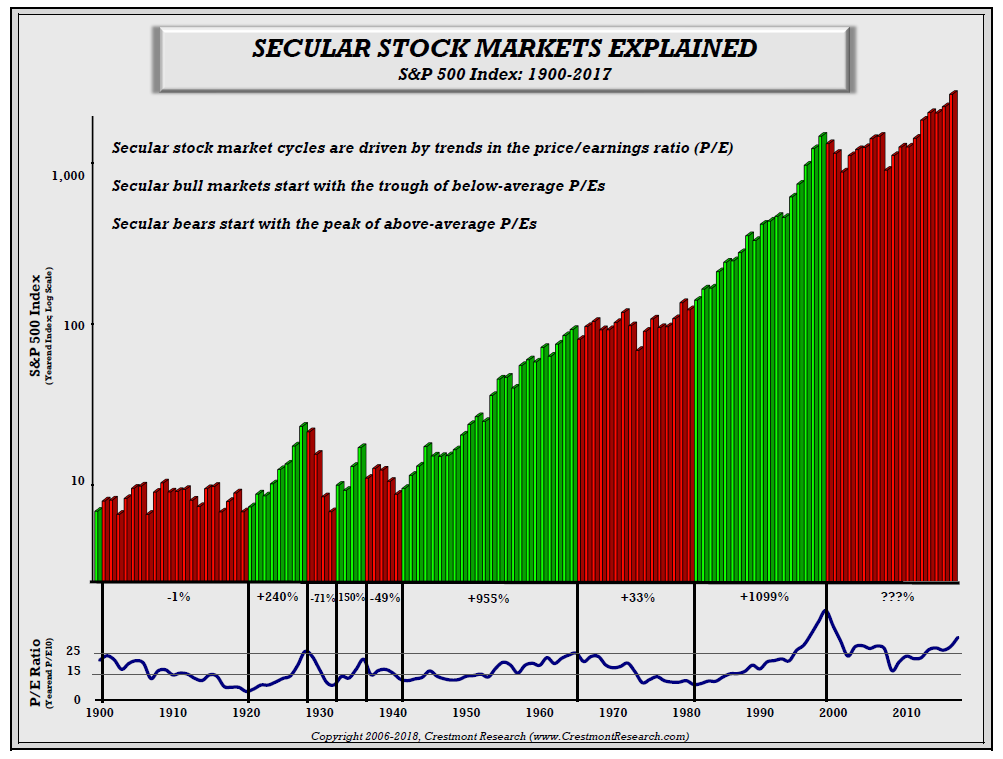

Given stock market cycles, it makes sense to position your portfolio to take advantage of the opportunity and capture growth in up markets, while also providing meaningful diversification during down markets.

Secular Stock Markets Explained Source: Crestmont Research.com

Secular Stock Markets Explained Source: Crestmont Research.com

Third party links disclosure – By clicking on these links, you will leave our website. The link you have selected is located on another server. We have not independently verified the information available through these links. The links are provided to you as a matter of interest.

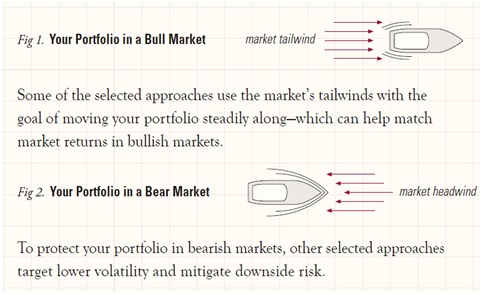

Not unlike navigating a boat at sea, if the market weather is favorable, you will want to take advantage of market tailwinds to “sail” toward your financial goals. And if the market is stormy, you will likely prefer to “row” closer to shore to protect your portfolio from full force of the gales. The challenge is to find a way to accomplish both of these goals in an unpredictable market that can change directions at anytime.

Not unlike navigating a boat at sea, if the market weather is favorable, you will want to take advantage of market tailwinds to “sail” toward your financial goals. And if the market is stormy, you will likely prefer to “row” closer to shore to protect your portfolio from full force of the gales. The challenge is to find a way to accomplish both of these goals in an unpredictable market that can change directions at anytime.

To meet this challenge, we recommend that you prepare your portfolio for uncertain investment “weather” by putting in place a thoughtful mix of “sailing” and “rowing” approaches based on your individual goals and the market outlook rather than relying on a single approach.

.

.

“Our diversified approach is grounded in long-term fundamentals with adjustments for today’s markets.”

Sailing & Rowing Investment Strategy:

A global tactical strategy that seeks to utilize different asset allocation approaches to secure gains in advancing markets and protect capital in sideways to negative markets.

Sailing Strategies

– Objective: Capture Participation

– Relative Return Investment Approach

- Benchmark-constrained strategies that are primarily driven by the market

- Seek to take advantage of the financial tailwinds of bull markets to capture investment returns

.

Rowing Strategies

– Objective: Deliver Competitive Returns Minimize Market Risk

– Tactical, Alternative & Absolute Return Investment Approaches

- Not constrained by a benchmark & freedom to delink from the market

- Strive to avoid risks in bear markets when financial headwinds threaten an investor’s progress

.

Diversifying across widely differing asset allocation approaches (“sailing and rowing”) offers a technique for not only meeting the challenges posed by today’s highly unpredictable environment, but also potentially improving the risk-reward tradeoff across both bull and bear markets.

A combination of approaches aim to take advantage of up markets and lower your overall portfolio volatility.

1 .

Our strategies may also employ alternative asset classes, in an effort to help achieve further diversification or reduce risk.

.

.

At Lighthouse Financial Strategies, we utilize diversified, long term risk managed and disciplined strategies. We are globally active and at times tactical. While other financial services professionals continue to embrace the traditional “buy and hold” mentality, we prefer to be more engaged in our clients’ investments. Our goal is to capture the majority of the upside movement while trying to avoid the major downturns that can disrupt a portfolio.

.

We can’t control the market but we can offer an investment process designed to navigate volatility with confidence and help you achieve your financial goals.

.

Tactical… “We believe that even the most challenging environments present opportunities to succeed.”

Sailing and Rowing: An Investment Strategy for Today

This four-minute video helps investors better understand market environments and what they can do to potentially reduce volatility while still seeking positive returns in their portfolios.

In the video you’ll see:

- How long-term Bull and Bear markets suggest strategies for reaching your goals.

- How deeply-diversified approaches to allocating your assets can keep you on track.

Our strategies offer investment solutions designed to help guide you toward your goals.

Although none of us can accurately predict the future, we can prepare for what lies ahead. We look forward to working with you to construct a portfolio that is designed to fit your investment needs and help you navigate these volatile markets with confidence.

“Our Philosophy is Clear: to do what is right for our clients, each and every day.”

”We’ll help you Navigate the risks and rewards of the markets.”

.

.