Women often face unique challenges and circumstances throughout their lives. That’s why we’ve launched this new resource and education information center that looks at different financial topics from a woman’s perspective. Money management; navigating the business world; the financial implications of marriage and raising a family; as well as retirement, estate, and investment planning — these are just some of the topics that we’ll explore in the Resource Center below.

Suddenly Single: 3 Steps to Take Now

Here are 3 steps to take right now that may make a difference if you find yourself suddenly single.

Widowed or Single Again?

“When you’ve lost your partner, the road to financial security is anything but clear, let us help guide you on your way?”

We understand some of the deep emotions that you might be experiencing at this traumatic time in your life. Sadness, confusion, anger….. Sorting through the box of financial paperwork, alone, is not something that you really feel like doing, but you know there are some important documents you ought to deal with. It’s never a welcome task, even during the best of times.

We can help you turn the negatives into positives. First we will clear the financial fog of insurance policies, retirement pensions and investments and explain these to you in “plain English”. Then, using an in-depth discovery process, we will help you decide what is really important to YOU now.

We will then help you navigate the multitude of decisions and actions that must be addressed as soon as possible. These include:

• locating and organizing financial and legal documents

• understanding how much cash you have on hand

• defining your personal goals before being bombarded with well-meaning advice from others

• coordinating the efforts of your attorney, your CPA, and other business professionals

“Advice and financial planning with the focus on YOU!”

.

.

Remember; It’s about you and what’s important to you.

.

So contact us to arrange a confidential meeting at our expense when you are ready.

.

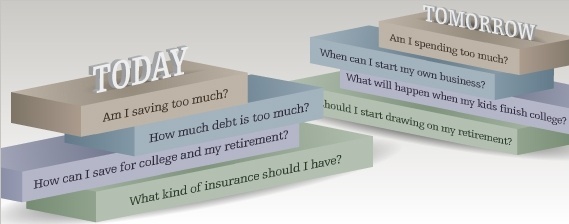

Women and Retirement

Women are great at multi-tasking. But many drop the ball when preparing for retirement.

FACT: 95% of women will be their family’s primary financial decision-maker at some point in their lives.

Source: Women and Investing Report. investmentnews.com, 2012

.

Request a free email copy of your own “WOMEN & MONEY” WORKBOOK

How Healthy are Your Finances? Take Our 360 Financial Compass Check to get your “bearings” and find out.

.

.

.

You can order hardcopy versions and additional worksheets of “myWorth” information, seen below, to help plan for a life you can depend on.

.

.

First Things First… Get Organized.

Are your financial records and legal documents organized in a safe place?

An important, and often overlooked, part of financial planning is simply being able to access information and documentation when you need it. Fortunately, organizing your important documents is not difficult, and once we help you set up your personal “File Safe” system it takes only a few minutes every year to maintain.

.

Contact us here to ask about our financial document organization kit.

.

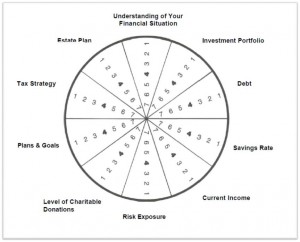

Use our “Financial Target Wheel” worksheet to see where you stand in the important areas of financial planning. It can help you set priorities.

“Helping you feel confident and secure about your future is at the heart of what we do.”

To comprehend your entire financial picture and most important your values, relationships and dreams, our first meeting focuses on you and what is important to you. At this meeting we’ll work with you to complete your Discovery Workbook, which allows us to develop an in-depth picture of your financial position, your goals and objectives, and your tolerance for risk.

.

![]() Click link here to see and to start your own Discovery Workbook

Click link here to see and to start your own Discovery Workbook

.

Consider having a written financial plan done to help you have a better understanding of your own financial situation.

Our “FINANCIAL COMPASS” planning program can help guide you from where you are to where you want to be.

Life is about creating yourself.” – George Bernard Shaw

.

Consider taking advantage of our “Quality Of Life” Coaching Service

Quality Of Life (QOL) Coaching is all about your  goals, your growth, and the development of pathways that will work for you. The foundation for our QOL Coaching service, is assisting you with ongoing 90 day plans to help you achieve what is most important to you.

goals, your growth, and the development of pathways that will work for you. The foundation for our QOL Coaching service, is assisting you with ongoing 90 day plans to help you achieve what is most important to you.

Having a vision for the future and planning for that vision are as important as money in achieving and fulfilling your dreams, goals and objectives.

My goal, as your Quality of Life coach, is to help simplify your life, allowing you more time to focus on your quality of life and the things that matter most to you. Identifying and clarifying what is important to you allows us to have a better understanding to guide my interactions, advice, and service to you.

![]() RETIREMENT REALITIES FOR WOMEN

RETIREMENT REALITIES FOR WOMEN

.

Third party links disclosure – By clicking on these links, you will leave our website. The link you have selected is located on another server. We have not independently verified the information available through these links. The links are provided to you as a matter of interest.

This material and all information shown, including any examples, is provided for educational purposes only and does not constitute tax, legal, or other individualized advice. While the information contained herein has been obtained from sources deemed reliable, Lighthouse Financial Strategies cannot be held responsible for any direct or indirect loss resulting from the application of the information provided here. Individuals should consult a qualified tax professional or attorney regarding their specific situation.

“Our goal is to help simplify your financial life so you have more time to spend on your quality of life and the things that matter most to you.”

.