“FINANCIAL COMPASS” Planning Program

We help clients answer the two most fundamental financial questions of life: “Will I make it, and do I have any financial blind spots?”

.

.

In answer to the question, “Will I make it?” I have found, over the past 20 years of dealing with these two questions, that the majority of people I speak with haven’t even defined “it”!

“A map won’t help without a destination.”

So, the first thing we do is sit down and help you define everything you are trying to accomplish with your wealth. We then take a look at everything you’re doing financially to determine if what you want to happen actually has the chance to occur. We basically map your current financial structure to your overall short term and long term financial objectives. If those two things align we pat you on the back and tell you congratulations. If they don’t align, we point out your specific challenges and give you detailed recommendations to help you get back on track.

So, the first thing we do is sit down and help you define everything you are trying to accomplish with your wealth. We then take a look at everything you’re doing financially to determine if what you want to happen actually has the chance to occur. We basically map your current financial structure to your overall short term and long term financial objectives. If those two things align we pat you on the back and tell you congratulations. If they don’t align, we point out your specific challenges and give you detailed recommendations to help you get back on track.

Once we have addressed Question 1, we move to Question 2: “Do I have any financial blind spots?” At this stage, we determine if there is anything you might have overlooked that might do you, your family or your business harm. Any risk exposure we uncover will be brought to your attention and again we will provide a rational strategy designed to help mitigate the risk.

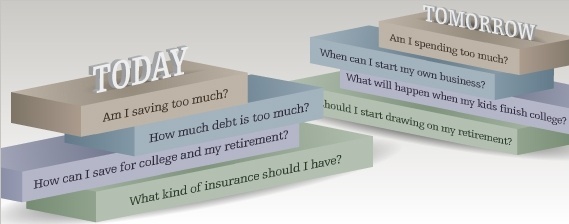

If you’re like most people, you probably have many other questions and concerns regarding the health of your financial future, such as:

- Is my financial plan missing key components, organized, or even nonexistent?

- Do I have several different financial representatives managing my investments, retirement plan, taxes and insurance?

- Do I lack confidence in my financial plan?

- Do I find myself second guessing my financial decisions and do they tend to be made emotionally?

If you answered “yes” to any of the questions above, you may be setting yourself up for a volatile financial future. The FINANCIAL COMPASS planning program was designed to integrate all aspects of your financial profile and provide you with the peace of mind and confidence that you deserve.

Financial Planning is about your goals, hopes & dreams & living the life you want to live.

By offering clients affordable financial planning, insurance and risk assessment and investment advisory services complete with estate planning, we provide a holistic approach to financial planning.

At the conclusion of this in depth process, you will not only have a comprehensive wealth management strategy in place, but our FINANCIAL COMPASS planning program will have addressed the only two questions that have ever kept you up at night: “Will I make it, and do I have any financial blind spots?” 360 Financial Compass Check

Do you have a written plan, so that no matter what happens in the market, the economy or the world, you could still feel confident about achieving your goals?

How Healthy are Your Finances? Take Our Financial Compass Check to get your “bearings” and find out.

Our “FINANCIAL COMPASS” planning program can help guide you from where you are to where you want to be.

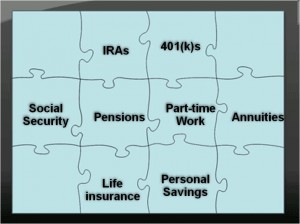

Planning can help you estimate potential retirement

income from each piece…

.

.

.

…then, it can help you make the right decisions

to avoid outliving your income and assets.

. See THE BIG PICTURE

A Customized Financial Plan

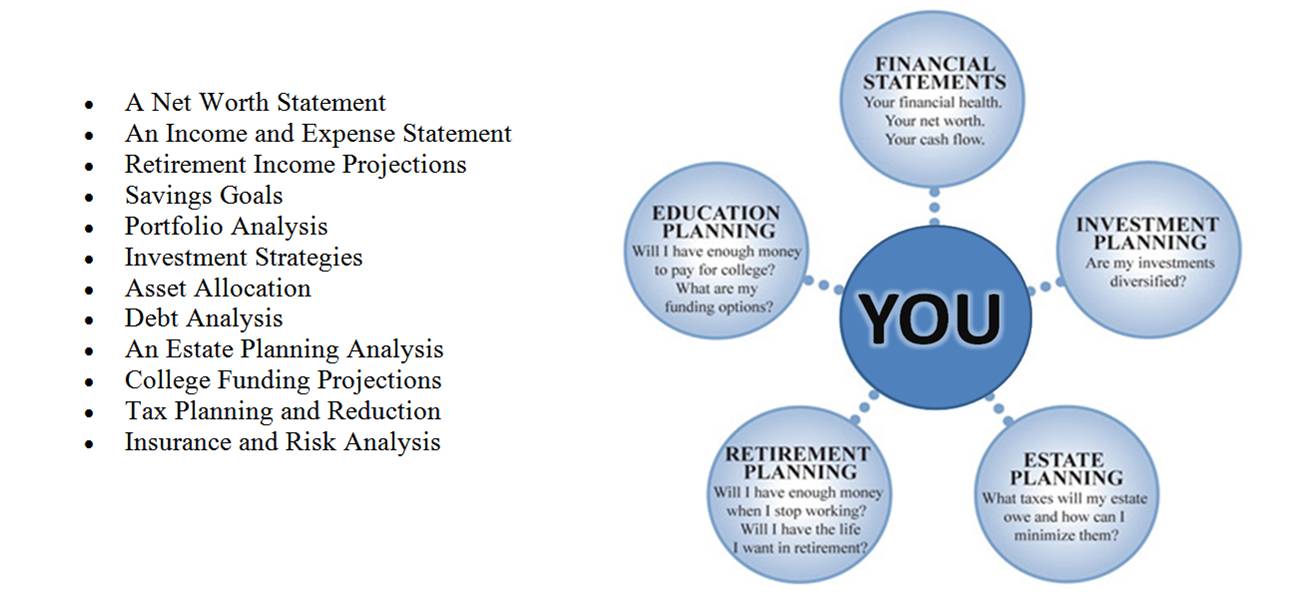

Your journey starts with a complimentary consultation that allows us to discuss your unique financial situation and to gather the information necessary to prepare your own personalized financial plan. Your financial plan will focus on those goals that you have articulated and will give specific recommendations on how to meet them. We will discuss what is important to you, including your dreams, visions, values and goals. We will explore your risk tolerance, expectations for returns, various investing styles, and how we manage money. The financial plan that we produce for you will typically incorporate the following:

“Do More Than Dream… Plan.”

Your personal FINANCIAL COMPASS plan should address all of the relevant issues shown here. You may or may not need help or advice with all of them.

“Most families spend more time planning a family vacation than they spend planning the last 20 to 30 years of their lives.”

Preparation of Estate Planning Documents

While we provide estate planning advice, the preparation of estate planning documents should be provided by an estate planning attorney. We work with several area attorneys or will work with your attorney to prepare basic estate planning documents (Wills, Powers of Attorney, Living Wills and Medical Directives) for our clients. This is part of our FINANCIAL COMPASS program.

Click link here to go to our Insurance & Estate Planning page

“Plan today, for the security and freedom you desire for tomorrow.”

One of the benefits of working with us is our ability to provide clear, easily understood explanations of financial planning products and services.

The personalized FINANCIAL COMPASS planning program that we provide acts as a roadmap to working toward a more secure and confident financial future.

.

If we could design a plan to help you maintain your lifestyle in a comfortable retirement, provide support for your most important relationships and help secure your financial legacy, would you like to start that conversation?

We’re looking forward to using our expertise to help you pursue your financial dreams and goals.

.

Contact us here to start your customized “Financial Compass” plan.

“Let us be your Financial Compass.”

.

.