Navigating Your Financial Journey

Helping you feel confident and secure about your future is at the heart of what we do.”

Travel with a guide you can trust to help you reach your financial destination. LFS Brochure

Strategy of a Successful Market Mariner

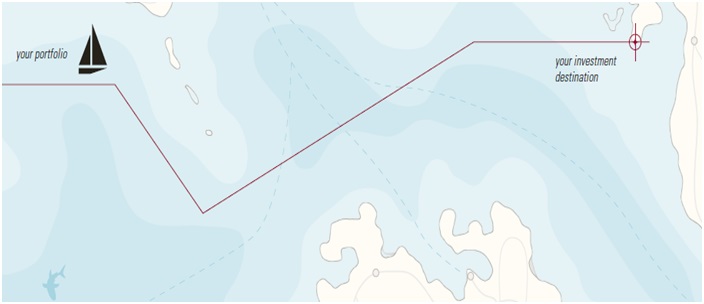

Markets, like seas, are ever-changing and unpredictable. A successful market mariner must have investment strategies that can “sail” when conditions are favorable and “row” when conditions are adverse. Sailing strategies help investors take advantage of the winds driving strong bull markets, while rowing strategies help them stay on course through bear market headwinds and choppy waters.

We believe there are times to take advantage of the market environment and times when the priority is simply to avoid market risk. This is why we feel a flexible approach to investing is needed.

We help prepare your portfolio for changing markets by putting in place a thoughtful mix of asset allocation approaches and strategies based on your individual goals and market outlook.

Accumulating wealth throughout your life takes persistence and focus. It’s a journey, and reaching your destination can mean a better life and security for you and your loved ones. To set and steer a course, you may need help from a guide you can trust.

Confidence about your investments requires being clear about your goals and comfortable with the advice you get for reaching them. That comfort comes from the trust we work hard to earn, starting with our first meeting.

.

“Do More Than Dream… Plan.”

.

Creating and sticking with a plan

From understanding your goals and circumstances to creating and monitoring your portfolio, we provide a thorough investment consulting process. We work with you, helping you manage your investments at every life stage.

Our investment consulting process is a disciplined means for helping you navigate changing markets. We use it to plan, implement and monitor your investment strategy. You can think of the process as a way to get your bearings, take your first steps, and keep your goals in sight. The process is backed by research that is designed to help ensure your portfolio adapts to changing market conditions, with the goal of keeping you on course.

Developing your strategy

To create an investment strategy that seeks to keep you on course in a variety of market conditions, we need to understand your circumstances and what you want to accomplish. We work with you to answer a number of key questions.

Choosing your route

Choosing your route

You might believe that the key to successful investing is buying a diverse group of securities and holding them for years, but over the past decade—and for long stretches of the past century—that approach alone hasn’t been effective. When markets are volatile, we believe it is particularly important to avoid deep losses in your portfolio.

We have access to a variety of asset allocation approaches that address varying market conditions. They range from aggressively seeking to capture market returns to minimizing risk regardless of market direction. By combining approaches, and aligning them with your goals, we strive to help your portfolio perform optimally to reduce the impact of market volatility.

The investments we recommend are based on research by a variety of established industry professionals. Their strategies are regularly monitored to assure they’re sound, and that they appropriately reflect those professionals’ investment philosophies. These strategists range from large institutions to smaller specialists—together they provide a broad range of approaches that accommodate nearly all investor needs. As your life unfolds and your needs evolve, we can alter the mix of these approaches to reflect them.

“That’s what we do. We help our clients get to their financial destinations.”

Considering the forecast

We talk about our view and get your opinion of the current market and economic environment, and the outlook for future years. We combine that outlook with your investment stance to recommend how you should allocate your assets. Again, our main goal is for you to be clear and confident about where your money is put to work. We keep you informed of changes in the economy and the markets and discuss how the portfolio modifications we recommend are designed to take advantage of current environments.

Overcoming obstacles

On your financial journey, you’ll face many obstacles and challenges. One of them is the sheer volume of information that can bombard you. It’s challenging to decide who to listen to, especially when those offering advice aren’t familiar with your circumstances and goals. Your money is too important—and financial products are too complex—to invest without a solid long-term plan. The strategy we develop is created in a manner to help enable you to avoid distractions, and we provide regular guidance so you don’t get off track.

Market volatility is another big challenge for most investors. Historically, financial markets have moved through long-term cycles marked by broad gains and declines. When markets are gaining, making progress toward your goal is easier. But how do you respond when markets are declining? We can help. We’re with you for the long haul, seeking to keep you on course for your destination regardless of how the market ebbs and flows.

”We’ll help you Navigate the risks and rewards of the markets.”

Perhaps the biggest obstacle between you and your financial goals may surprise you—it’s your emotions. Given information overload and market volatility, there may be times when you lose confidence—when you’ll want to change direction or even give up. Research shows that investing based on emotional responses causes many investors to make ill-timed decisions, with costly results. (Source: Quantitative Analysis of Investor Behavior 2012 by Dalbar, Inc. This study found that for the period of 1992-2011, the average equity investor saw returns of 3.49% while the Standard & Poor 500 Index saw returns of 7.81%).

”Your financial journey is not a sprint. It spans years, even decades. And we’re committed to supporting you the whole way.”

We help you counter your emotions by meeting with you to provide perspective about your long-term goals and helping you be disciplined about achieving them.

Staying the course

An important part of our job is keeping you informed. We regularly review the performance of your portfolio, and explain any recommendations we have for making adjustments. We keep in touch about your circumstances and use what we learn to keep your investments on course for your destination.

We also make available a body of information about investment strategists, industry research and other data to give you background on our efforts. We’re always happy to discuss that information or any other input you gather, to help you learn and be comfortable about your investments.

Our clients are a diverse and dynamic group and we are honored to serve as a guide on the journey they envision. We specialize in working with individuals to achieve long-term results and make a difference in their lives. We help you create and navigate a disciplined path to your goal, earning your trust by making sure you’re clear about your progress. We strive to help you feel confident and calm about that, however economic environments change.

Successful people view life as a journey and aren’t afraid to stop and ask for directions.

Past performance does not indicate future results. Inclusion of indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect the actual investment performance. Individual investor’s performance will vary. The Standard & Poor’s 500 index is an unmanaged index of 500 widely-held companies often used to represent the broader market.

A trusted advisor supports your financial journey—one that lasts for the rest of your life. Helping you feel secure about your future is at the heart of what we do. We’d appreciate the opportunity to start earning your trust.

Talk to us about how we can help you navigate your financial journey with confidence.

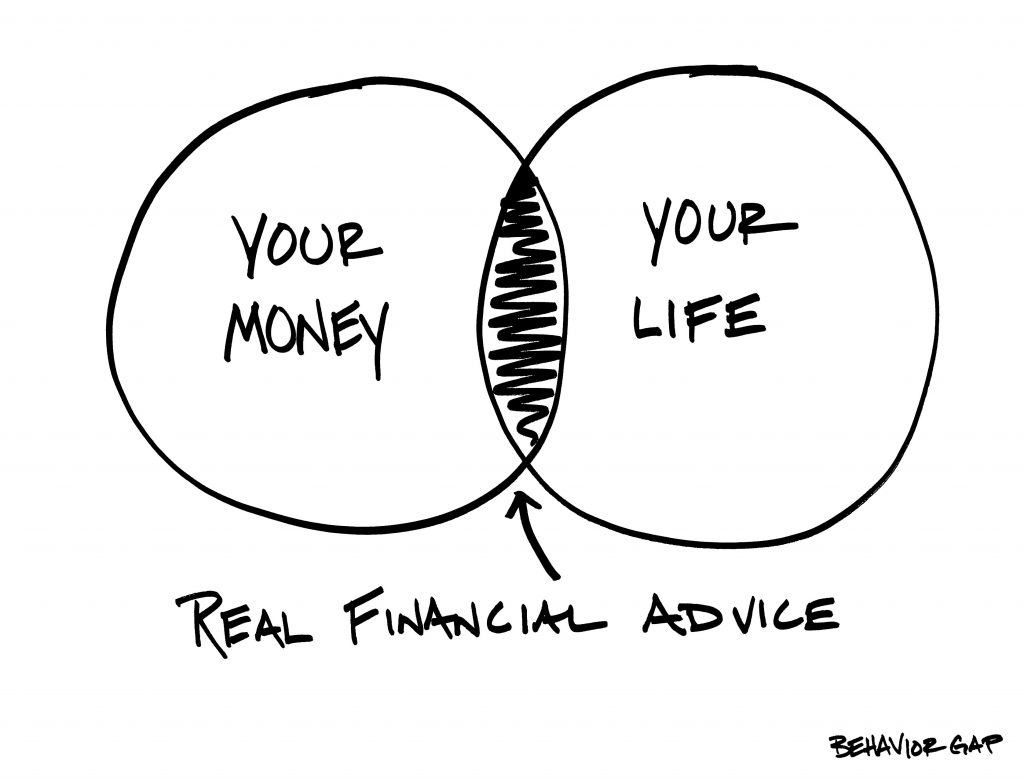

“Most people think financial planning is about money. It’s about your goals, hopes & dreams, & living the life you want to live.”