Navigating Retirement

Navigating Retirement

“What kind of written plan do you have forecasting income and living expenses in retirement, to ensure that you don’t run out of money?”

“What’s my income?” is the overriding question to ask when planning for retirement.

Is there a question more important for a retiree to answer?

You probably know the amount of savings you’ve accumulated, but knowing your “number” is different than knowing your “income.”

Our Income Planning Strategy was developed to help you answer this important question.

The plan places emphasis on both the present and future income needs of retirees. It’s central objective is to provide reliable, inflation-adjusted income for life.

“The objective of your personalized strategy is making sure you have enough money as long as you live.”

Mt. Everest – This video shares with you an interesting analogy between retirement planning and climbing Mt. Everest.

330.758.7545

“You’re one-of-a-kind.

Your retirement income plan should be, too.”

Our Retirement Income Plans start with establishing 2 Primary Goals

1. When You would like to Retire

2. How Much Income You will Need/Want to fund Your Lifestyle

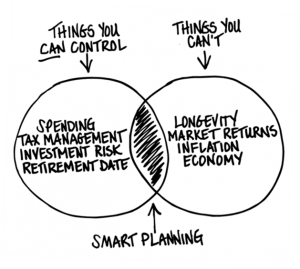

Our Strategy takes into consideration:

• Longevity • Rates of return on investments

• Taxes • Social Security and Pensions

• Inflation • Changes in your circumstances

“We can help simplify your retirement planning so you can enjoy a confident & secure retirement.”

We use a “Time Segmentation” or “Bucket Approach” Income Planning Strategy

We organize and separate your assets based on your Investment Time Horizon.

We set aside assets in conservative investment programs to give you SAFE and RELIABLE income for a 5-10 year period.

We allocate the remaining assets in more growth-oriented investments to insure your income plan is sustainable over the long haul.

“This is the most effective Income Planning Strategy I have found in my 25+ years in Retirement Planning!” – Mike F. Moss

The planning strategy will give you a clear picture of what you are up against and where you stand.

It allows us to run an unlimited number of “What If” Scenarios;

• The difference in Retiring at 60 vs 62 vs 65

• Raising and lowering Income levels

• Changing the expected rate of Inflation

• The Impact of higher and lower rates of return of your portfolio

• Etc.

It shows you what is realistic and what isn’t. The results may show that you are in great shape or it may show some challenges ahead. But the most important thing is it will give you is an Accurate view of where you stand.

“You can always modify a financial plan. But you can’t modify a plan that doesn’t exist.”

“At Lighthouse Financial Strategies We Specialize In Retirement Income Planning.”

ROI has a VERY different meaning during retirement.

The investment and tax strategies used to successfully accumulate wealth cannot be successfully applied when creating a retirement income plan. They are two entirely different animals.

While you Accumulate money, What matters is the “average” return or ROI (Return On Investment).

While you Distribute money, What matters is the ROI (Reliability Of Income).

The 3 Phases of The Money Cycle.

Understand The Money Cycle and its effect on your Retirement.

We find one of the biggest mistakes that pre-retirees make is bypassing the preservation phase of the money cycle entirely.

Do NOT skip the important Preservation Phase → → → →

- Asset accumulation

- Asset long-term growth (ROI)

- Current savings

- Time to recover from market downturns

- Tax-deferred growth

Focus During the Preservation Phase – The 5-7 Years Before & The 5-7 Years After Your Retirement Date – Don’t Forget this Important Phase of Life, if there is a Market Downturn you will regret it.

- Preservation of some assets (Not All)

- Downturns immediately felt

- Sequence of returns risk

Focus during the Distribution Phase – ROI (Reliability Of Income)

- Current income distribution (ROI)

- Longevity risk

- Asset long-term growth

- Downturns immediately felt

- Sequence of returns risk

- Required minimum distributions (RMDs)

.

“It’s 1:30 on Wednesday, your first week of retirement, WHERE are you at and WHAT are you doing?”

5 Risks during the Distribution Phase

Longevity Risk

- Outliving your money

- Plan through, not to your retirement!

- People are living longer in retirement

.

Inflation Risk

.

Financial Market Risks

- Drops in value leading to potential shortfall

.

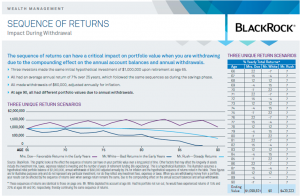

Sequence of Returns Risk (Timing Risk)

-

- When you retire can be as important as with how much

- When you experience market returns, not what market returns you experience

- Timing Risk is how you can average 7% a year in the market over 20 years, only taking out 4% per year and still go dead broke!

.

Health Care Costs

- Rising cost of health care

- Custodial/Home Care

- Home Health Care

- Medicare vs. Long Term Care

.

To learn more, visit the links to the right of the page.

.

Contact us here to discuss the

above in more detail, and as it pertains to your personal situation.

.

“Achieving the dream of a secure, comfortable retirement is much easier when you have a written plan.”

If you are about to retire, or already retired, a major concern for many people, is will I have enough money to last my lifetime?

We offer an investment strategy with the objective of providing an inflation adjusted income for life. Our strategy allocates assets in a manner that places a heavy emphasis on streams of income that continue over long periods of time. This is extremely important because Americans are increasingly being forced to rely upon their own retirement savings to create the retirement income they will need. With longevity increasing and interest rates low, creating reliable streams of retirement income can be challenging. Our strategy provides a sound foundation for creating the needed income for a comfortable retirement.

To obtain your personalized Income Analysis or to schedule an appointment, contact us here.

.

“Think about it; a 25 or 30 year vacation is a long time.”

To learn more about our Income Planning Strategy, download our Strategy Concept Overview with the link on the right.

Income Planning Strategy, download our Strategy Concept Overview with the link on the right.

Or you can visit our Retirement Income Planning web page with the link below.

.

.

“When your vision is clear, your decisions can be easier.”

.

Ultimately, your retirement will come down to your Reliability Of Income (ROI). That will be realized by how you plan and manage your resources.

Get Started by meeting with us to discuss your plans for retirement. Together, we’ll review your goals, sources of income and current portfolio value as well as your time horizon, asset allocation and market volatility.

Based on What’s Important To You, we will recommend a personalized distribution strategy that gives you confidence that your retirement savings will last as long as you do.

.

“Most families spend more time planning a family vacation than they spend planning the last 20 to 30 years of their lives.”

.

“Are you prepared for a lifetime of Saturdays?”

For more Retirement info checkout these resources starting with the J.P. Morgan “Guide to Retirement”

“Plan today, for the security and freedom you desire for tomorrow.”

This Income Planning Strategy may not be suitable for all investors, and there is no guarantee investing in the strategy will meet all of its investment objectives.

Third-party links disclosure – By clicking on these links, you will leave our website. The link you have selected is located on another server. We have not independently verified the information available through these links. The links are provided to you as a matter of interest.