Your Retirement Income Strategy

“Achieving the dream of a secure, comfortable retirement is much easier when you have a written plan.”

Your Retirement Income Plans start with establishing 2 Primary Goals

1. When You would like to Retire

2. How Much Income You will Need/Want to fund Your Lifestyle

Our Strategy takes into consideration:

• Longevity • Rates of return on investments

• Taxes • Social Security and Pensions

• Inflation • Changes in your circumstances

“What kind of written plan do you have forecasting income and living expenses in retirement, to ensure that you don’t run out of money?”

.

Your Income Plan Analysis will give you a clear picture of what you are up against and where you stand.

It allows us to run an unlimited number of “What If” Scenarios;

• The difference in Retiring at 60 vs 62 vs 65

• Raising and lowering Income levels

• Changing the expected rate of Inflation

• The Impact of higher and lower rates of return of your portfolio

• Etc.

It shows you what is realistic and what isn’t. The results may show that you are in great shape or it may show some challenges ahead. But the most important thing is it will give you is an accurate view of where you stand.

“This is the most effective Income Planning Strategy I have found in my 25 years in Retirement Planning!”

.

.

This unique approach gives us 3 very powerful advantages

1. Gives us a real sense of what our Retirement looks like and gives us an honest evaluation.

2. It completely guides our investment allocation process. We understand (maybe for the first time) what we own and why we own it.

3. In our reviews it adds a much needed layer of accountability to your plan when we compare the projected results to your actual results each and every year.

* We can make any needed adjustments in a timely manner.

YOU NEED TO UNDERSTAND THAT THE TAX AND INVESTMENT STRATEGIES USED TO SUCCESSFULLY DISTRIBUTE WEALTH ARE INHERENTLY DIFFERENT THAN THOSE USED TO SUCCESSFULLY ACCUMULATE WEALTH.

“The objective of your personalized strategy is making sure you have enough money as long as you live.”

ROI has a VERY different meaning.

The investment and tax strategies used to successfully accumulate wealth cannot be successfully applied when creating a retirement income plan. They are two entirely different animals.

While you Accumulate money, What matters is the “average” return or ROI (Return On Investment).

While you Distribute money, What matters is the ROI (Reliability Of Income).

.

“This is important. Don’t confront retirement without a plan for monthly income.”

.

Retirees face many risks. Three BIG risks that can potentially devastate retirement security are:

1. What if I pick a bad year to retire? (Timing Risk or Sequence Of Returns Risk)

2. Will my income keep pace with rising prices? (Inflation Risk)

3. Will my income last my entire lifetime? (Longevity risk)

It’s important to understand these risks and then think about ways you might try to plan for them. Having a Written Income Plan, forecasting income and living expenses in retirement, is the first step.

“Sequence Of Returns Risk (a.k.a. Timing Risk) may be on the verge of wiping out retirement for 10s of millions of baby boomers, yet most of them never even heard of it!”

Timing Risk is how you can average 7% a year in the market over 20 years, only taking out 4% per year and still go dead broke!

Here is a somewhat, simplified explaantion of Sequence Of Returns Risk a.k.a. Timing Risk:

Let’s say you have a person with a diversified portfolio and they are taking a systematic monthly withdrawal of money out of that portfolio in retirement. Well as long as the market is going up they are fine. But as soon as that market starts going down do you know what they have to do? They have to take out more shares of the asset than normal, And when the market grows back none of that grows back with the market because they just took it out and spent it for retirement. So the asset is not there to fully recover when the market recovers.

Then if the market goes down again do you know what they have to do? They have to take out more and more and more. And when the market grows back none of that grows back with the market because they just took it out and spent it again.

And all it takes is a couple of those dips, early in retirement, before the portfolio can enter a death spiral that it can’t recover from.

No one can predict what the market will do when you start taking withdrawals for income.

.

“Don’t Leave Your Retirement To Chance.”

.

In Retirement, The Sequence of Returns (Timing Risk) Can Make or Break a Portfolio. This is how you run the risk of running out of money.

Don’t leave your retirement security to good luck, or bad. In Retirement you need a Retirement Income Specialist to help you with Reliability Of your Income (ROI).

.

“You can always modify a financial plan. But you can’t modify a plan that doesn’t exist.”

.

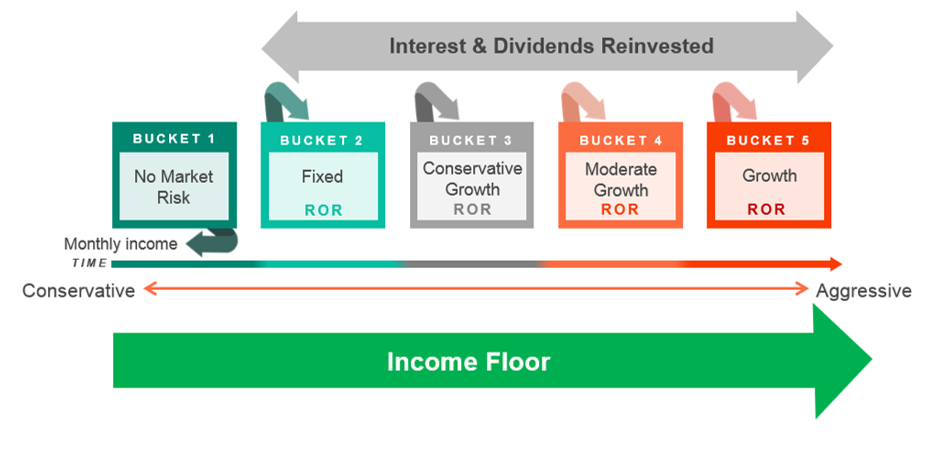

Your custom Retirement Income Plan uses a Strategic Combination of Asset Allocation and Product Selection with the following Five GOALS:

1. Reduce the impact of emotions by making sure your monthly check is provided by a stable investment.

2. Increase income to help maintain purchasing power throughout retirement.

3. Reduce Risk.

4. Preserve Principal.

5. Realize the best possible chance of achieving excellent investment results by keeping assets invested over long periods of time.*

Together we can develop a Custom Designed Income Plan using this Investment Strategy with the goal of delivering Predictable, Reliable, Sustainable, Inflation-Adjusted (rising) Income during your Retirement years.

“When was the last time you felt really good about your financial goals?”

.

“Are You Confident In Your Income Plan For Retirement?”

We help ensure that the money you need in the near term is safe and predictable, and not subject to the day-to-day market fluctuations, while simultaneously putting you in a position to receive the long-term market returns required to provide an increasing income stream throughout your entire life. HOW do we do that?

We use a “Time Segmentation” or “Bucket Approach” Income Planning Strategy

We organize and separate your assets based on your Investment Time Horizon.

We set aside assets in conservative investment programs to give you SAFE and RELIABLE income for a 5-10 year period.

We allocate the remaining assets in more growth oriented investments to insure your income plan is sustainable over the long haul.

Suppose a bear market occurs just as you retire. Since your retirement income strategy pulls cash from deposit accounts and fixed-income investments first, your equity positions have time to rebound.

This helps mitigate Sequence of Returns Risk / Timing Risk.

“At Lighthouse Financial Strategies, we Specialize in Retirement Income Planning.”

Let’s talk about What’s Important To YOU?

Because everyone’s situation is unique, no one income strategy will work for all investors. By determining what’s important to you in retirement — growth potential, guaranteed income, flexibility, potential preservation — we can help pinpoint the strategy that is right for you.

Because everyone’s situation is unique, no one income strategy will work for all investors. By determining what’s important to you in retirement — growth potential, guaranteed income, flexibility, potential preservation — we can help pinpoint the strategy that is right for you.

You’ve spent your adult life saving for retirement. Now take the next logical step and work with us to help you take a smart approach to spending and maximizing your savings.

Get started by meeting with us to discuss your plans for retirement. Together, we’ll review your goals, sources of income and current portfolio value as well as your time horizon, asset allocation and market volatility.

by meeting with us to discuss your plans for retirement. Together, we’ll review your goals, sources of income and current portfolio value as well as your time horizon, asset allocation and market volatility.

“Be more confident about your retirement.”

Lets Get Started…

To obtain your personalized analysis or to schedule an appointment, call Mike Moss @ 330.758.7545 or email Mike.Moss@LFScompass.com. .

* This Income Planning Strategy may not be suitable for all investors, and there is no guarantee investing in the strategy will meet all of its investment objectives.

“The retirement you dream about begins with a plan.”